PRODUCTS

Solve your cases faster with the fitting tools!

IRIS

Automated GDPR-compliant screening solution for organisations that need to support their risk assessments with the power of OSINT.

The Internet supports many analysts with the ability to screen companies and people to grant permits to start a business, assess (credit) risk or perform compliance investigations. Web-IQ Screening Intelligence tools automate this labour intensive discovery process.

Through our API’s and/or UI, an automated real-time online analysis takes place by using the open web of news, media articles, online pages, social media, customer reviews, images, underground markets & forums and more.

Why choose Web-IQ for your screening processes?

- Conveniently available

- Real time internet intelligence for all cases with increased risk via our API’s or manual deep-dives via our UI.

- Privacy first

- GDPR-proof by minimising data storage and maximising privacy-by-design.

- Optimised workflow

- Filter, categorise and score results for process driven and risk based decision making.

- Reveal insights

- Uncover blind spots and present relevant results in an explicit way.

- Time saving

- Save time by straight-through processing for the benign majority and focus your precious time on the cases that matter.

Start using IRIS today

If any of the above-mentioned services fit your current company’s needs, please do not hesitate to contact Web-IQ for further details and a demonstration

Online Due Diligence

Use the power of OSINT for unique and actionable customer insights

Prevent criminal and fraudulent customers from entering your client base by identifying risks from online open sources and stay compliant with the Anti-Money Laundering regulations (AML/CFT) and combat fraud.

Open Source Intelligence to know your customers better

With our Online Due Diligence solutions we bring top-tier technology from the world of Law Enforcement to the fraud-detection teams and systems of financial institutions and insurance companies.

By using Open Source Intelligence technology, our solution makes all publicly available information actionable in order to find risk indicators such as criminal activity, fraudulent behavior or relationships with people from sanction, PEP and other watchlists from all over the world. Especially in an increasingly competitive and digital environment where the speed of bringing a customer on board is key, and maintaining a qualitative risk analysis, our solution fulfils a key role in facilitating the acceleration of the client acceptance processes from several days to potentially just minutes.

Why organizations choose Web-IQ

Actionable risk data

from information outside your existing databases, like social media, forums and other public online information.

Analyze more data

by utilizing the whole public internet, instead of only the first page of your search results.

Reduce cost and errors

by standardizing and automating repetitive online due diligence work.

Example use-cases per industry

Financial industry

Insurance industry

Corporate industry

Identify criminals and fraudsters at your gate by investigating online connections with watch-lists or fraudulent behaviour and be compliant with AML/CFT laws.

Detect potential fraudulent claims by automatically identifying risks from online sources, like informal relations between persons involved in a claim.

Investigate and monitor your customers, vendors, suppliers and other third parties for potential risks that affect your reputation or impose a compliance risk.

Skip tracing

Significantly increase your contact success

Find defaulting debtors that cannot be found with our special forensic technology and thus significantly increase your contact rate.

Find new contact information with OSINT

With online skip tracing solution, we provide cutting-edge technology used by law enforcement agencies to locate people and businesses online to find and extract their public contact information.

Less Impact of Late PaymentIf you know your customers better, you can act quickly in the event of a payment default. |

improve contact rate

Because you have up-to-date contact information

at hand.

Increase in ROI

On your acquired NPL portfolios.

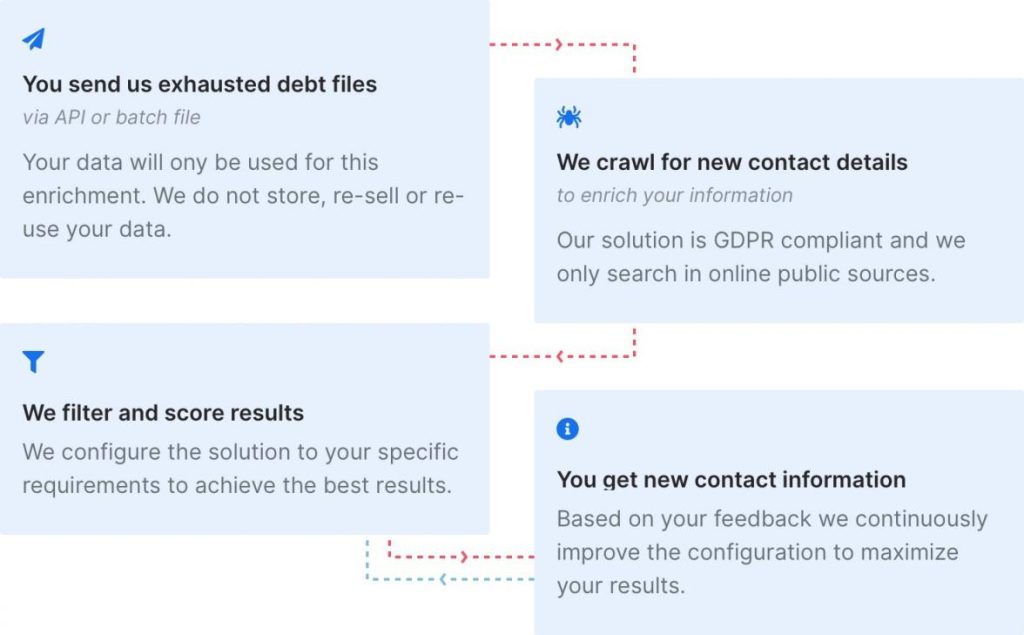

That's how it works:

Given the information, our forensic web crawlers search and extract relevant publicly available information online.

The results are then analyzed and filtered based on algorithms that match and verify the newly found contact information. Based on your specific needs and feedback, we configure and optimize the solution to maximize results. Once the data process is complete, all data is completely removed from our systems.

For further information please contact us or click here.

Contact persons

Our experts are happy to help you.

Jonathan Graeff

Hardware & Software Sales, COO

E-MAIL: jonathan.graeff@mh-service.de

PHONE: +49 (0) 7275 40444-53

Johannes Seitz

Hardware & Software Sales

E-MAIL: johannes.seitz@mh-service.de

PHONE: +49 (0) 7275 40444-52